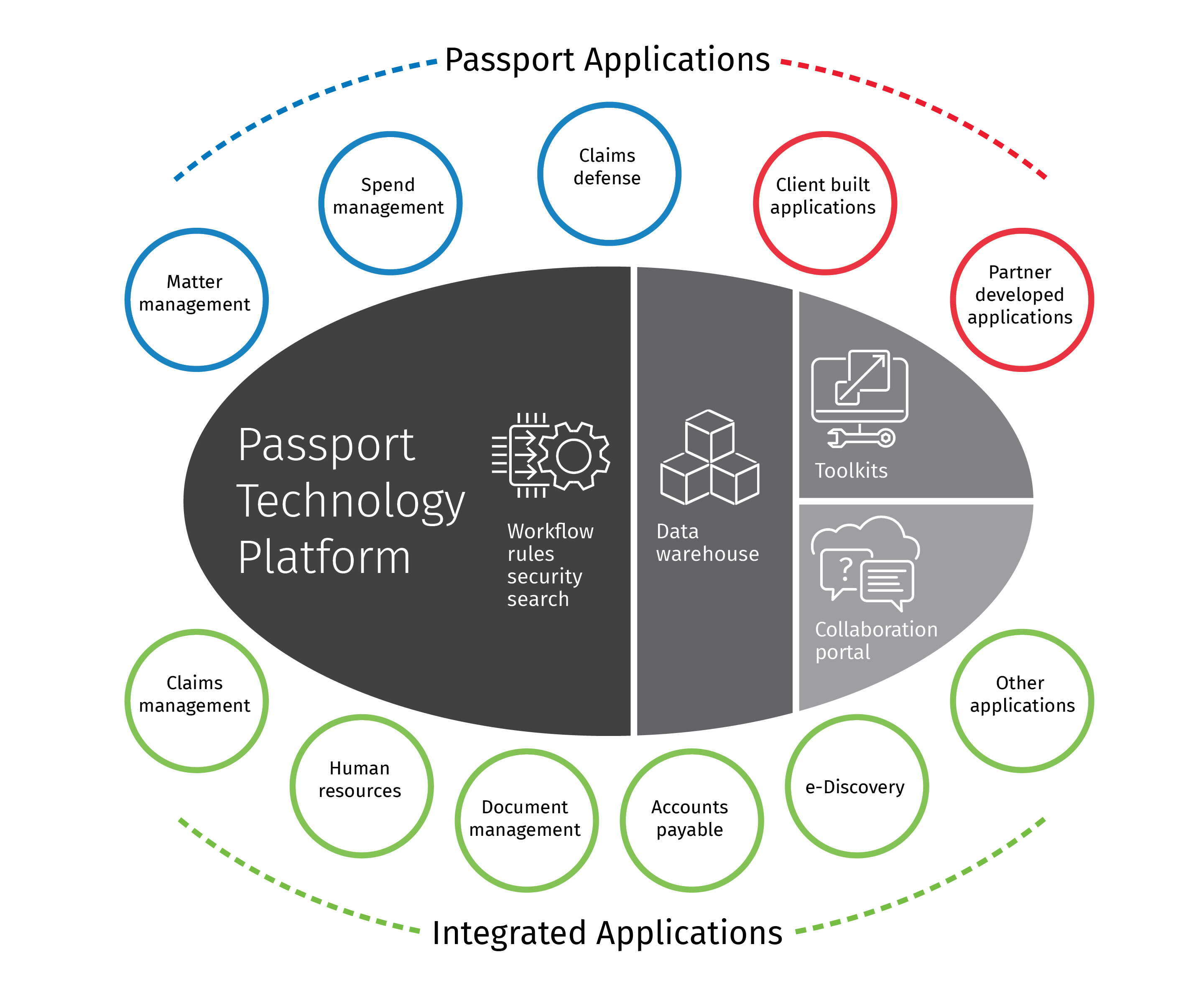

Passport applications can be deployed individually or seamlessly combined to deliver a unified solution for managing legal and risk-related data across the enterprise. With its flexible, open, and integrated technology platform, you can easily connect different systems and processes on a single, secure, and collaborative framework.